n the field of digital banking specifically, and mobile payments in general, the majority of market share is held by the big players. So, what should new entrants do to attract and retain customers in this market?

In the 16th episode of the Deep Dive series, let’s join Brands Vietnam in reconnecting with Mr. Nguyen Hai Minh, CEO of Wisdom Agency, to discuss market trends and analyze brand architecture and communication strategies for new players breakthrough in the digital banking sector.

Deep Dive is a series of in-depth interviews that explores significant decisions, topics, and notable events in brand building, marketing, advertising, and communications.

* In recent times, many banks have started developing mobile money and digital banking applications. From your perspectives, Mr. Minh, what are the reasons behind this shift?

In the previous episode, we discussed the topic of rejuvenation in traditional banks, specifically ACB. In this episode, we will delve into the story of digital banking. From my perspective, these two topics are interconnected: The banking market, being an established industry, is predominantly dominated by the big players.

In my opinion, the current situation of banks is comparable to that of the soft drink market a few years ago. At that time, because the market for carbonated soft drinks was reaching saturation, Pepsi and Coca-Cola could not grow their market share. It was only when Tan Hiep Phat introduced a series of non-carbonated beverages that Pepsi and Coca-Cola were aware of the enormous neighboring market. However, by then, they had missed the opportunity to become the leaders in that new and sizable market.

The same applies to banks, as it is currently very challenging for them to increase their market share by a few percentage points in a “red ocean”. This demands substantial investments in product development, as well as communication strategies. However, the emergence of the digital banking market has created a more equitable opportunity for competition among banks.

Source: FinanceBuzz

Another factor is that people, especially the youngster, increasingly favors convenient and fast mobile payment methods. Therefore, if banks do not want to lag behind in adapting to this new era, whether they want to or not, they must participate in the market.

Notwithstanding, each bank will enter this market with a different mindset. Specifically, for a large and well-established bank, they may choose to enter with the purpose of meeting their existing customer base’s needs. In this case, they may not invest excessively but rather focus on providing the necessary level of digital banking services.

For banks seeking robust growth in the digital banking sector, they will invest more to achieve market leadership.

Next in line are newly established organizations, or even well-established organizations that have not been active in the financial sector. However, they also want to develop their own payment platforms, so they will also enter the mobile payment market, which bears significant resemblances to digital banking. Prominent examples include Momo, ZaloPay, and ViettelPay.

Therefore, depending on the objectives and needs of each bank or financial organization, they will have different strategies and approaches.

Source: VnExpress

* In your opinion, Mr. Minh, do banks that want to venture into mobile payment or digital banking need to adjust their corporate structure and corresponding brand architecture? It is known that there are three common brand architectures: master brand, endorsing brand, and stand-alone brand. Could you explain this matter further?

Before delving into the topic of brand architecture, let me briefly discuss corporate strategy. In the series of articles “War and Marketing” published on Brands Vietnam, I wrote about how brands can apply principles from warfare to their positioning and corresponding communication plans.

I would also like to add that this is the reason why “The Art of War” by Sun Tzu, despite being written in the 5th century BC, is still applicable in business today. Within this ancient text, there are two fundamental strategies: defense and offense. The defensive strategy is suitable for established giants with a solid market share. They enter the digital banking market to protect their existing customer base. Therefore, they only need to do enough and leverage their existing advantages. On the other hand, an offensive strategy is new players’ only way to gain market share, which is the second mindset I just mentioned.

Accordingly, depending on the business strategy, each company will choose the corresponding brand architecture. In reality, there are up to 8 types of brand architectures or even more, depending on different schools of thought. However, for the purpose of this discussion, I will not delve into the details of each specific type but focus on discussing 3 common brand architectures in the digital banking market.

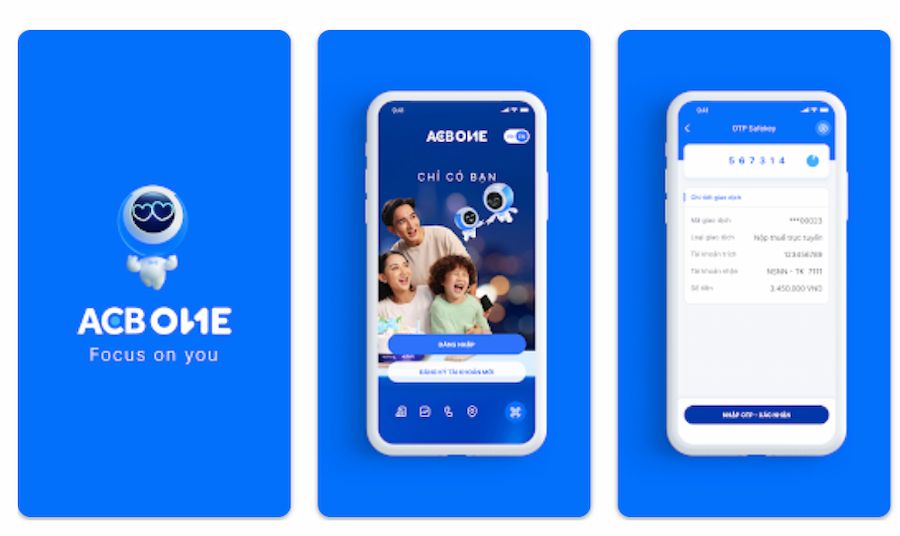

Firstly, there is the master brand architecture. With this type of architecture, there is a strong connection between the parent brand and the sub-brand, which is evident through the brand names, such as a shared prefix. For example, the digital banking application of ACB is called ACB ONE (which includes both the parent brand name and the product name).

The second type is the stand-alone brand. With this architecture, the sub-brand has no association with the parent brand. Some notable examples include Digimi, the digital bank of Ngan Hang Ban Viet, and TNEX, a digital banking service by MSB Bank.

Thirdly, there is the endorsing brand architecture. This can be seen as a combination of the two aforementioned brand architectures. I would describe it as an endorsing model, where the sub-brand (endorsed brand) and the parent brand (endorsing brand) are connected but not as explicitly as in the master brand architecture. For example, Timo Bank (whose full name is Timo Powered by VietCapital) follows the endorsing brand structure. In this architecture, the name of the sub-brand takes precedence, followed by the name of a larger corporation serving as the endorsing brand.

Therefore, when examining the brand architecture, I can partially discern their strategy and direction. For instance, opting for a stand-alone brand architecture implies a distinct orientation for the two brands. For example, one brand targets the traditional customer group, characterized by a preference for safety and familiarity. The other brand is tailored for the younger customer segment, who favor promotional shopping services and embrace new and timely trends. For such reasons, they choose to separate the two brands without any interconnection to enable convenient focus on the two distinct directions.

Besides, if a bank enters the digital banking market with a master-brand architecture, it indicates their intention to solely introduce new products and services to the existing customer base. Hence, they do not require the creation of a separate brand to target new customer segments.

Lastly, the endorsing brand architecture is a more complex strategy to implement in practice due to its hybrid nature. Therefore, businesses must comprehend brand architecture to effectively leverage its advantages compared to the master brand and stand-alone brand structures.

Of course, each strategy possesses its own pros and cons, and there is no truly perfect brand architecture. Therefore, how can one select the appropriate structure based on the brand’s execution capabilities and available resources?

In my opinion, there are two important factors that a brand needs to pay attention to. Firstly, it is the core business strategy of the company. The second factor is resources, including personnel and budget. These two factors will determine which brand architecture model is suitable for the new business model.

* Nowadays, people tend to use digital banking and e-wallets as alternative payment methods. In this context, with popular payment apps like Momo and ZaloPay already well-established, how can new digital banks attract and retain customers?

From my perspective, for traditional banks with a fixed market share, entering the digital banking market may simply be a means to offer additional products and services to retain their current customers. This can be seen as a defensive strategy with a focus on safety. In reality, it is not always necessary to be a pioneering name and accept all risks. Take Apple as a prominent example; they are not always at the forefront of new technologies but rather learn from and build upon the experiences of those who came before. Therefore, this can also be a suitable and straightforward approach for existing banks.

Source: VietnamPlus

For organizations that are compelled to choose a serious offensive strategy and invest significantly in the digital banking sector, they must first encounter certain risks. These risks include, but are not limited to, factors related to human resources, financial resources, and the long-term nature of implementation. Entering a new market requires a considerable amount of time, effort, and money. This is similar to the e-commerce market a few years ago when companies entering the market had to “burn money” and endure losses for a long period. However, they continued to invest in order to reap the “sweet fruit” in the future. The same applies to the digital banking market, where in order to capture a significant market share in the future, businesses need to invest heavily in long-term resources and capital.

Furthermore, the mobile payment market already has prominent players such as Momo, ZaloPay, and Apple Pay. Although Apple Pay may be relatively unfamiliar in Vietnam, they have achieved a certain level of popularity worldwide. Apple has also leveraged its existing customer base when launching new products. Therefore, it is important for banks and organizations seeking to enter this field to capitalize on existing strengths and have a clear development strategy for the future.

* When looking at the bigger picture, specifically the landscape of the digital banking market, in your opinion Mr. Minh, what are the advantages and disadvantages that exist in this market?

Firstly, as I mentioned, a new market brings many barriers for businesses, requiring long-term investment in resources and finances. Therefore, a safe option for established businesses entering this new market is to employ a defensive strategy, which involves leveraging their existing customer base, adding new feature services to retain customers, and gradually expanding their target audience. From my observations, most banks are following this direction.

However, it is crucial for the brand architecture to align with the business strategy. There have been cases where the brand structure is inconsistent with the core strategy. In this section, I will analyze a case study as an example for businesses to refer to.

Secondly, in the digital banking market, there is sometimes an overlap between new and existing products. This can cause users to hesitate and question the necessity of downloading another payment application. Sometimes, these products even compete with each other. Therefore, banks and financial institutions need to recognize that products without significant features will quickly be phased out.

Furthermore, the mass customer base is often considered a “luxury playground” reserved only for big players because they have abundant resources and finances. If resources and finances are limited, brands should focus on meaningful differentiation. This could be through a standout feature or targeting a niche customer segment, such as a group of young music or sports enthusiasts.

Thirdly, the next step is to build a suitable brand architecture accompanied by corresponding communication activities. This allows consumers to easily understand the unique aspects of the new brand and feel convinced enough to download the application.

Lastly, similar to the 22 immutable laws of marketing, as the market matures, only a few players have the ability to sustain themselves.

* Mr. Minh, could you provide an example of a digital bank that focuses on a specific feature and targets a specific segment?

I have previously explained quite clearly about the three common brand structures when banks enter the digital banking market. I have also mentioned the master brand structure quite extensively above. Therefore, I will provide an example of Digimi – a digital bank by Bản Việt, with a stand-alone brand architecture structure.

From the name itself (Digi from Digital and Mi from Gen “Mi”), although Digimi doesn’t explicitly state it, it can be understood that they aim to position themselves as a digital banking product focused on technology and targeting the new generation, those who tend to focus on themselves. The use of foreign language, the prefix “Digi,” and the clever wordplay with “mi” are a clear statement by the company about a new product that is distinct from the traditional banking model, not focusing on existing customers but seeking new customers—tech-savvy young individuals who are self-focused and potentially have a rich digital lifestyle. This positioning is quite broad as the company chooses “technology” and “people” rather than tying the brand to any specific product or feature. From my external analysis perspective, this could be a far-sighted vision for the brand, going beyond just being a digital bank or payment method. In the future, Digimi may become more than just a digital bank—it could evolve into something greater. This is a common scenario for brands that start with relatively broad names.

Source: Digimi

Regarding the execution activities, it seems that Digimi is targeting active and sports-loving young individuals, specifically basketball enthusiasts. On their official media platforms, Digimi regularly posts content and images related to sports competitions. Notably, they also sponsor events such as VUG – Vietnam University Games and the SEA Games. With this direction, it can be seen that Digimi expects young sports enthusiasts to choose to accompany them in the future. I haven’t fully connected the dots between their name choice and user file selection, so perhaps we need to observe Digimi’s market approach in the near future to truly understand the coherence in their strategy. However, as I have shared many times before, an effective communication strategy always needs to adhere to the 4Ps principle (Product, Price, Place, Promotion). Therefore, after choosing the stand-alone brand architecture and a specific customer segment, Digimi should implement its products and services while adjusting policies accordingly. In my prediction, in the coming time, Digimi will continue to carry out communication activities focusing more on sports fans, such as sponsoring other sports like football, badminton, etc. If they do it well, there is a high possibility of building a digital banking ecosystem specifically designed for this compact but valuable customer segment.